XRP Price Prediction: Navigating Volatility Between $2.80 Support and ETF Catalysts

#XRP

- Technical support at $2.80 with Bollinger Band positioning suggesting potential reversal zone

- ETF decision timeline extending to October 2025 creating both uncertainty and future catalyst potential

- Growing institutional adoption through payment solutions providing fundamental utility expansion

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Key Support

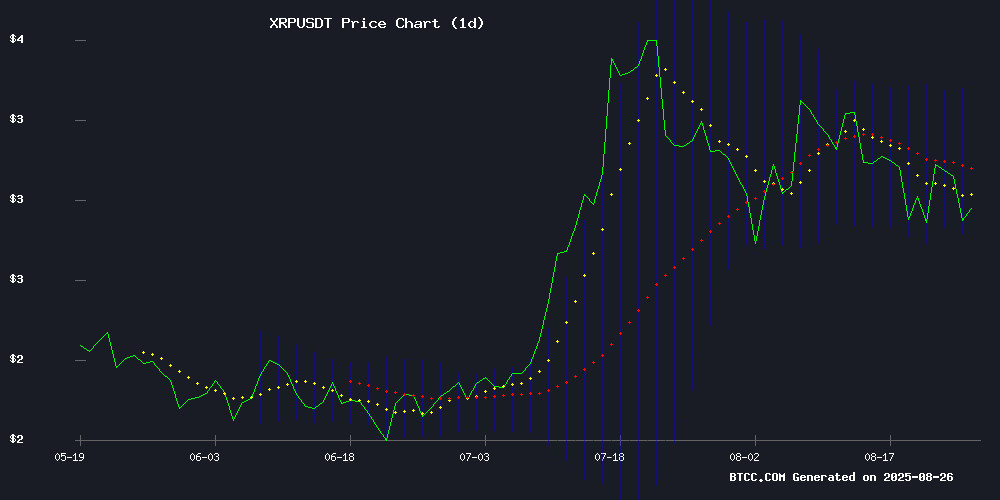

XRP is currently trading at $2.9083, below its 20-day moving average of $3.0841, indicating short-term bearish pressure. The MACD reading of 0.1307 versus 0.0671 shows bullish momentum remains intact, though the histogram at 0.0636 suggests weakening upward thrust. According to BTCC financial analyst Michael, 'The price hovering NEAR the lower Bollinger Band at $2.7984 presents a critical support test. A bounce from this level could target the middle band at $3.0841, while a break below may trigger further declines.'

Market Sentiment: Regulatory Delays Offset by Product Innovation

Recent news presents a balanced landscape for XRP. Gemini's cashback credit card launch with Ripple and growing whale accumulation provide fundamental support, while the SEC's delay of the WisdomTree ETF decision to October 2025 creates regulatory uncertainty. BTCC financial analyst Michael notes, 'The expansion of real-world utility through payment solutions like the Gemini card builds long-term value, but short-term price action remains susceptible to ETF approval timelines and broader market volatility.'

Factors Influencing XRP's Price

XRP Price Dips as Gemini Launches Cashback Credit Card Amid Whale Accumulation

XRP faces downward pressure, slipping below $3 with a 5% decline amid broader market sell-offs. Key support levels emerge between $2.97 and $2.84 as trading volume spikes 119% to $12.58 billion, signaling heightened trader interest.

Gemini's limited-edition XRP credit card offers 4% cashback on fuel, EV charging, and rideshare purchases, potentially driving new utility adoption. Meanwhile, large holders continue accumulating, with whale addresses now controlling 10.6% of total supply—a bullish divergence from price action.

XRP Slides 3% Amid Volatility Despite Gemini-Ripple Credit Card Expansion

XRP faced a 3.2% decline, dropping from $3.01 to $2.91 during a turbulent 24-hour trading window. The sharpest sell-off occurred between 19:00–20:00 GMT, with volumes spiking to 217.58 million—triple the daily average—as institutional liquidation accelerated. Late-session buying pared losses slightly, but the token struggled to reclaim key levels amid divided market sentiment.

August has been marked by heightened volatility for XRP, with repeated rejections above $3.00. Whale activity and institutional flows have exacerbated price swings, leaving retail traders exposed. The underperformance contrasts with broader crypto market gains, as regulatory uncertainties continue weighing on Ripple's native token.

Gemini's new XRP credit card partnership with Ripple and WebBank introduces tangible utility, offering 4% cashback in XRP for fuel and EV charging, with tiered rewards for other categories. Select merchants will provide up to 10% rebates—a bullish counterpoint to recent price action.

XRP Price Rally Shifts Focus to Emerging PayFi Projects Like Remittix

XRP's 8.56% surge to $3.03 on August 22-23 has reignited trader interest in altcoins, with institutional flows signaling sustained adoption. Analysts highlight $3.00 as a critical support level, with a breakout above $3.10 potentially propelling the token toward $5 by 2025. Settlement volumes on the XRP Ledger have spiked 500%, though whale profit-taking introduces short-term uncertainty.

Meanwhile, Remittix emerges as a disruptive force in PayFi, having raised $21 million through its token sale at $0.0987. The project's 618 million token uptake and trading volume dominance over meme coins position it as a contender for exponential growth—experts project 50x returns by 2026. While XRP consolidates its institutional footprint, Remittix captures speculative capital seeking asymmetric opportunities.

SEC Delays WisdomTree XRP ETF Decision to October 2025

The U.S. Securities and Exchange Commission has pushed back its decision on the WisdomTree XRP exchange-traded fund, setting a new deadline for October 24, 2025. Cboe BZX Exchange filed the application, seeking a rule change to list and trade shares of the proposed ETF. This delay leaves Franklin Templeton’s XRP ETF as the only pending application without a postponement, with its next deadline looming next month and a final decision expected by November.

Grayscale’s XRP ETF filing faces the first major deadline on October 18, followed by other issuers in quick succession. Bloomberg analysts Eric Balchunas and James Seyffart estimate a 95% likelihood of approval this year, suggesting the SEC may greenlight multiple XRP ETFs simultaneously—mirroring its approach to Bitcoin and Ethereum ETFs earlier this year.

In preparation, all XRP ETF issuers have updated their S-1 filings, with Grayscale submitting a new registration statement for its XRP Trust ETF. Seyffart notes these revisions likely reflect SEC feedback, signaling constructive dialogue ahead of potential approvals.

XRP Price Prediction: Analyst Projects 200% Rally Amid ETF Buzz

XRP is trading near $2.96, with a strong support level established around $2.80. Analyst Javon Marks predicts a potential surge to $9.63, a 200% increase, driven by a breakout from a long-term wedge formation and renewed optimism from ETF developments.

The Canary American-Made Crypto ETF, focusing on U.S.-based digital assets, has injected fresh bullish sentiment into the market. XRP's technical momentum and historical patterns suggest a significant upward trajectory, with traders anticipating a decisive breakout.

XRP Charts Reveal Twin Bull Flags, $5 Target Eyed on Breakout

XRP has formed two distinct bull flag patterns on the weekly chart, signaling potential continuation of its uptrend. The first flag emerged after a breakout from a prolonged corrective channel, while the second shows tighter consolidation near the $2.4 support area.

Resistance at $3.4 remains a key level to watch, aligning with recent swing highs. A confirmed breakout could propel XRP beyond the $5 mark, according to technical analysts. @Steph_iscrypto emphasized the pattern as a pivotal continuation signal rather than a reversal.

The asset's recent price action reflects growing bullish sentiment, with traders monitoring support levels for confirmation of the next major move. XRP's weekly chart now presents one of the clearest technical setups in the crypto market.

XRP Prices Poised for a Significant Shift: Will It Rise or Fall?

XRP stands at a technical crossroads as it tests the boundaries of a symmetrical triangle pattern. The cryptocurrency's current price action near $2.95 signals impending volatility, with a decisive breakout expected within ten days. Market participants are watching the $2.80 support and $3.10 resistance levels for directional cues.

A breach above $3.10 could trigger a rapid ascent toward $3.30-$3.50, while failure to hold $2.80 may precipitate a decline to $2.70. The symmetrical triangle reflects market equilibrium, but such consolidation patterns typically precede substantial moves. Technical traders await confirmation of either breakout with heightened interest.

XRP Price on the Brink: How Close Is It to Joining the Top 50 Assets?

XRP must surge 52.3% to $4.48 to break into the world's top 50 assets by market capitalization. Currently trading at $2.94 with a $175.27 billion valuation, it sits just outside the top 100. Reclaiming the $3 threshold would propel XRP past BlackRock's $177.79 billion market cap, securing a position among the top 100.

Analysts observe a pattern of higher highs, suggesting a realistic path to the $4.47-$4.48 range this cycle. The token faces an $88 billion gap to match the 50th-largest asset. While Ethereum gained 7% last week, XRP dipped 0.76% despite favorable legal developments, underscoring its volatile positioning.

How High Will XRP Price Go?

Based on current technicals and market developments, XRP could see a rally toward $5 if it holds the $2.80 support and breaks above the 20-day MA at $3.08. This represents a potential 70% upside from current levels. However, this requires clearing several resistance zones and positive ETF developments.

| Scenario | Target Price | Key Conditions |

|---|---|---|

| Bullish Breakout | $5.00 | Hold $2.80 support, ETF approval |

| Neutral Consolidation | $3.00-$3.50 | Range-bound between Bollinger Bands |

| Bearish Breakdown | $2.50 | Break below $2.80, regulatory setbacks |